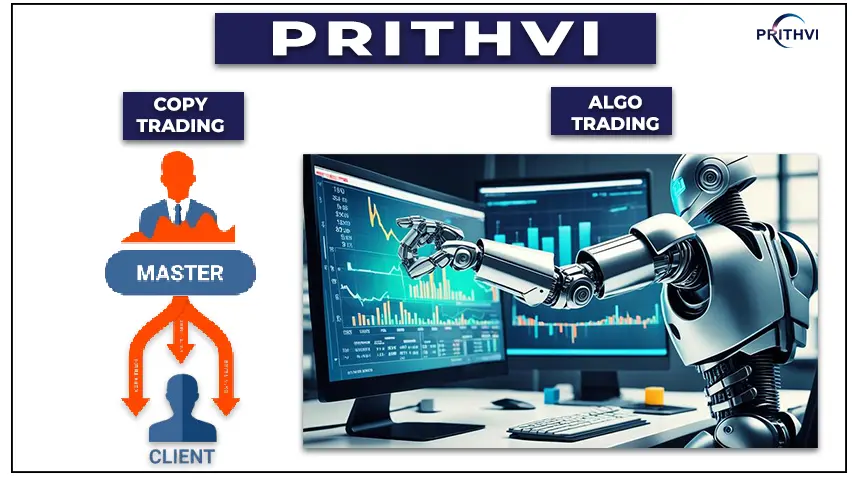

Copy trading and Algo trading in Prithvi Finmart

Prithvi Finmart gives both Copy Trading and Algorithmic Trading to beautify your buying and selling experience. Copy Trading lets in you routinely replicate the trades of successful buyers, making it easy to advantage of their expertise while not having deep market knowledge. Algorithmic Trading, on the other hand, uses automated techniques to execute trades based on pre-set criteria, ensuring speedy and unique trading execution. Both features are designed to assist customers make knowledgeable and efficient trading decisions on Prithvi Finmart’s platform.

How to copy trade in Prithvi Finmart

- Sign up/Log in: First, make sure that you own a Prithvi Finmart account. Register on their platform if you haven't already.

- To get to the element of replica enterprise: Go to the forum's Copy Business vicinity. Usually, this may be discovered within the Trading or Investment Services option.

- Look up retailers: Look for hooked-up stores that you could emulate. Typically, Earth Finmart offers profiles that encompass risk tolerance, trading approaches, and overall performance signs and symptoms.

- Select a dealer: Select a broker whose practices and hints coincide with your economic targets. Before choosing, study the employer's approach and past achievements.

- Invest: Choose the amount of finances that you wish to use to map out specific groups. The merchant's trades are reflected to your account beneath this amount.

- Start Copy: Enable the copy functionality. The buying and selling platform will Copy all trades from the chosen investors to the account you create once it is set up.

- Take a watch on performances: Keep a near eye on how successfully your replica buying and selling device is working. If your investing method changes or trader performance modifications, you could need to make modifications to your options or allocate.

Contact Us for Inquiries

Register for call back

Learn Simple copy Trading Strategies for Prithvi Finmart in points:

- Diversify into merchants: Spread your investments across multiple traders to reduce risk and increase potential returns.

- Follow the best performers: Choose traders who are consistent and earn good returns at critical times. Look at their performance metrics and trading history.

- Consider the level of risk: Traders whose risk level matches your risk tolerance. Higher returns often come with higher risk.

- Monitoring and editing: Regularly, you should review the performance of the traders you model and adjust your selection, if necessary, based on their recent performance or changes in market conditions.

- Start small: Start with a small investment to test the waters and understand how the design industry works before committing to larger sums.

- Distribute the budget: across multiple investors to reduce danger and growth capability rewards with the aid of diversification into traders.

- Examine the top individuals: Select investors who increase profits at vital points and are straightforward. Analyze their buying and selling enjoy in addition to performance facts.

What is Algo trading?

Algorithmic trading makes use of pc algorithms to perform the shopping for and selling of monetary belongings primarily based on predefined standards. It will increase transaction speed, accuracy, and efficiency with the aid of making transactions faster than guide channels. Traders can enforce complex strategies and retest to optimize performance using historical statistics.

Learn Simple algo Trading Strategies Prithvi Finmart in points:

- Set up an account: Make sure you have got an energetic buying and selling account with Earth Finmart.

- Accessing Algo Trading Tools: Visit the algorithmic buying and selling segment of the forum, wherein you can find tools and assets particular to Algo trading.

- Create or pick out a set of rules: Use Prithvi Finmart gear to create your buying and selling algorithm or select from pre-designed alternatives if available

- Back-testing231 strategies: Test your algorithms towards historical market facts and the usage of the platform’s lower back-checking out characteristic to assess their capacity performance.

- Deploy a set of rules: Once you’re happy with the backcheck outcomes, install a set of rules to let you make trades based on your standards.

- Monitor and regulate: Constantly screen the overall performance of your algorithms and alter them as vital based totally on real-time marketplace conditions and outcomes.

Copy Trading benefits at Prithvi Finmart:

- Easy to use: It allows novices to exchange experienced buyers, simplifying the trading procedure.

- Diversification: Facilitates diversification by employing investing in a couple of retailers with numerous strategies that allow them to invest in multiple outlets.

- Learning Opportunity: Provides insights into a hit buying and selling strategies and marketplace insights from skilled investors.

Algorithmic trading benefit at Prithvi FinMart:

- Efficiency and speed: Trades at a high fee of implementation, utilizing little fluctuations quicker than guided trading.

- Accuracy: Avoids mistakes made by human beings and emotional presumptions by verifying all activities are finished underneath set rules.

- Difficult techniques: Making it feasible to investigate past facts and optimize strategies through the mixing of complex commercial enterprise systems.

AI BOT Features:

- AI BOT-Algo Trading and Copy Trading is a web-based platform.

- AI BOT supports multiple brokers.

- AI BOT allows cross-broker copy-trading.

- AI BOT supports algo trading from various trading platforms eg. Trading View, MT4/5, Python, Excel, Amibroker, Ninja Trader, etc.

- AI BOT supports direct trading in multiple accounts in one click.

- AI BOT has basket order and one-click trade features.

- AI BOT can place a trade in thousands of accounts in one click with mili-seconds latency.

- AI BOT your trades can copied even when you are not suitable for part-time traders as well.

Check out the pricing details

Price

In conclusion:

Trading copies at Prithvi FinMart makes buying and selling easy by permitting customers to replicate the procedures performed by experienced buyers, making the trading platform easy to use in addition to enabling the introduction of many styles of merchandise. Advanced investors may now execute and make correct trades at speedy speeds and with extra efficiency way to algorithmic buying and selling. This allows for greater complicated strategies for successful trading. Both features increase the platform's productiveness and advertising and marketing possibilities.

Read more:

Copy trading and Algo trading in Tradebulls

Copy trading and Algo trading in Findoc