Copy trading and Algo trading in Findoc

By using Copy buying and selling in Findoc, you may robotically mimic the transactions made through excessive-performing traders, streamlining the funding system through using their know-how. Algorithmic shopping for and selling, alternatively, includes using computational techniques to perform deals under predetermined criteria, maximizing efficiency and speed. Algo buying and selling is useful for people who want to implement and improve complicated buying and selling strategies, while replication shopping for and promoting is exceptionally perfect for those who decide upon a hands-off technique. Both procedures have benefits but come with some dangers and fees that must be understood.

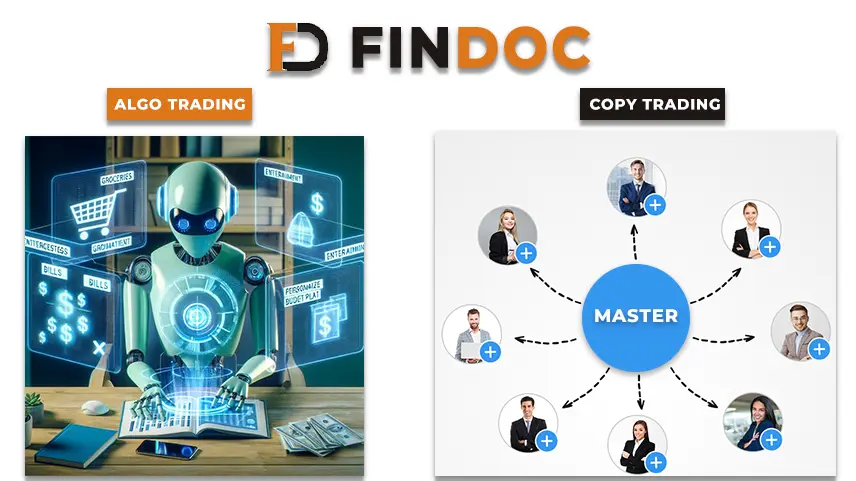

What is Copy trading?

Copy trading is a method where investors automatically replicate the trades of skilled and a hit trader, allowing them to enjoy the knowledge of others without actively coping with their trades.

How to copy trade in Findoc?

- Sign Up and Log In: Create an account on Findoc and log in.

- Explore Traders: Navigate to the copy trading segment to view a listing of pinnacle-appearing buyers. You can clear out based on performance metrics, techniques, and hazard stages.

- Select a Trader: Choose a dealer whose performance and method align together with your investment goals.

- Allocate Funds: Decide how much capital you want to allocate for copying the selected trader’s trades.

- Set Parameters: Configure any additional settings, inclusive of chance management alternatives or alternate limits.

- Start Copying: Activate the replica trading function. Your account will mechanically mirror the selected dealer’s trades in actual time.

- Monitor Performance: Regularly evaluate the overall performance of your investments and make changes if necessary.

Contact Us for Inquiries

Register for call back

Learn Simple copy Trading Strategies for Findoc in points:

- Diversify traders: Measure multiple traders with strategies to spread the risk and maximize positive returns.

- Focus on performance metrics: Choose traders based on their track record, position, and risk level rather than just short-term profitability.

- Align your goals: Choose brokers whose strategies and risk profiles align with your investment goals and risk tolerance.

- Start with a small investment: Start with a small amount of money to test the waters and make adjustments as you gain confidence in the design process.

- Regularly review and adjust: Periodically review the performance of imitative traders and adjust if their strategies are not aligned with your goals.

- Monitor market conditions: Identify market trends and conditions that can affect the performance of the traders you follow.

- Set risk management: Use whatever risk management tools are available to prevent potential losses and protect your capital.

- Stay informed: Keep up to date with news and updates about the vendors you are imitating to understand any changes in their policies or operations.

What is Algo trading?

Algorithmic trading (algo buying and selling) is the use of pc algorithms to automatically execute trades based on predefined standards, optimizing velocity and precision in the buying and selling method.

How to algo trade in Findoc

- Sign Up and Log In: Create an account on Findoc and log in.

- Access Algo Trading Tools: Navigate to the algorithmic buying and selling segment or gear provided via Findoc.

- Define Strategy: Set up or pick a predefined trading algorithm based totally on your approach, inclusive of fashion-following or suggest-reversion.

- Configure Parameters: Input the necessary parameters and criteria for the algorithm, including trading indicators, risk management regulations, and execution triggers.

- Backtest Strategy: Test the set of rules and the usage of ancient facts to evaluate its performance and make important modifications.

- Deploy Algorithm: Activate the algorithm to start buying and selling based totally on your configured criteria.

- Monitor and Adjust: Continuously display the set of rules’s overall performance and alter settings or techniques as wished.

Benefits of Copy Trading on Findoc:

- Ease of Use: Allows buyers to leverage the expertise of skilled buyers with no need for in-depth marketplace understanding.

- Diversification: Enables portfolio diversification by copying more than one hit investor with numerous strategies.

- Time-Saving: Reduces the time and effort required for guide buying and selling and marketplace evaluation.

- Learning Opportunity: Provides insights into the strategies and decision-making techniques of skilled traders.

- Automated Execution: Trades are finished routinely, reducing the ability for human error and emotional selection-making.

Check out the pricing details

Price

Benefits of Algorithmic Trading on Findoc:

- Speed and Accuracy: With the assistance of computerized trading, trades can be performed quickly and as they should be, taking benefit of opportunities inside the market that guide buying and selling ought to miss.

- Consistency: Adheres to established rules without showing any emotional prejudice or deviance.

- State-of-the-art Strategies: Makes it simpler to position massive-scale shopping for and promoting sports and complex buying and selling strategies into exercise

- Back checking out: Enables methods to be tested for the usage of preceding statistics so that it will enhance and refine performance before real buying and selling take vicinity.

- Trading Around-the-Clock: Algorithms are capable of operating continuously, seizing opportunities for purchases and income each time they get up.

AI BOT Features:

- AI BOT-Algo Trading and Copy Trading is a web-based platform.

- AI BOT supports multiple brokers.

- AI BOT allows cross-broker copy-trading.

- AI BOT supports algo trading from various trading platforms eg. Trading View, MT4/5, Python, Excel, Amibroker, Ninja Trader, etc.

- AI BOT supports direct trading in multiple accounts in one click.

- AI BOT has basket order and one-click trade features.

- AI BOT can place a trade in thousands of accounts in one click with mili-seconds latency.

- AI BOT your trades can copied even when you are not suitable for part-time traders as well.

Conclusion:

Findoc's Copy buying for and selling offers a real way of capitalizing on the knowledge of skilled buyers through constantly mirroring their deals, it is right for those searching for an arms-off method to investing. On the other hand, algorithmic looking for and promoting makes use of automated strategies to rapidly and appropriately execute offers, making it appropriate for people who choose to put into effect complicated trading strategies and trade continuously. Both strategies have precisely the same blessings; reproduction searching out and promoting specializes in ease of use and simplicity, the same time as algo buying and selling prioritize effectiveness and super method execution.

Read more: